Building Wealth with a Purpose

In the world of investing, there’s no one-size-fits-all formula. Every investor comes with different financial goals, risk levels, and timelines. That’s why asset allocation is one of the most powerful wealth management strategies. It helps you create an investment portfolio that’s balanced, diversified, and tailored to your life risk appetite — not the latest market buzz.

Think of it as your financial compass. Whether your goal is to generate passive income in India, plan for retirement, or grow financial wealth over the years, a smart asset mix is the first step toward it.

What is Asset Allocation?

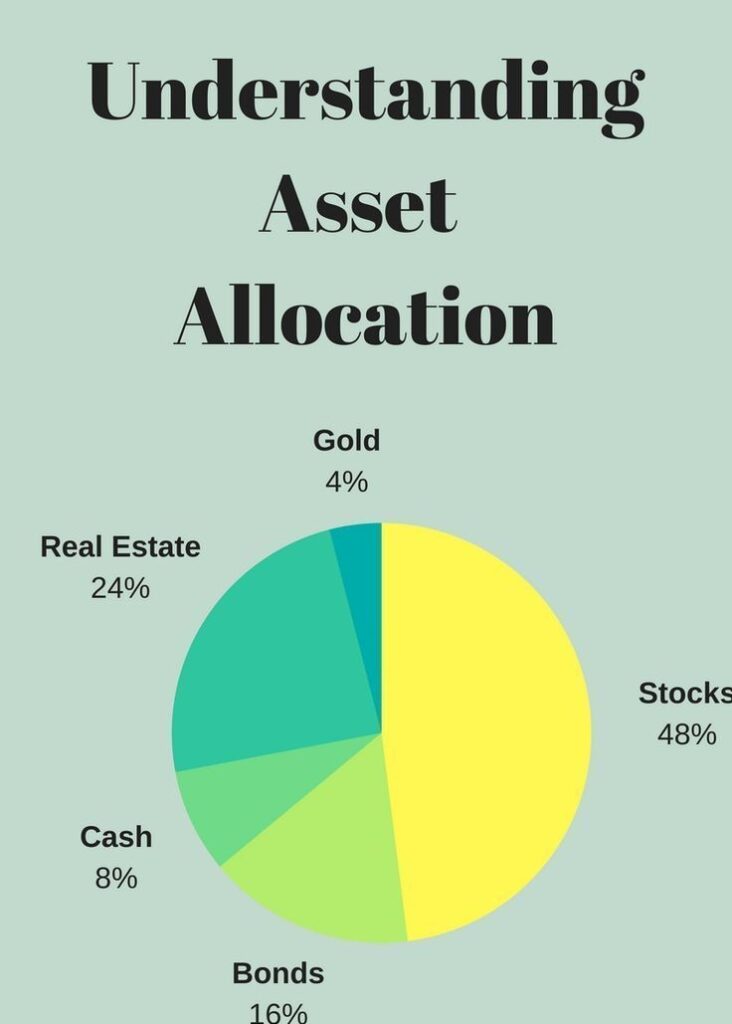

Asset allocation refers to dividing your investment portfolio among different asset classes. These may include:

- Equities (stocks) – for long-term growth

- Fixed-income instruments (like bonds or debt mutual funds) – for income and stability

- Cash or equivalents – for liquidity and emergency needs

- Real estate or alternative investments – for diversification and inflation protection

Your ideal allocation depends on your predetermined financial goals, risk appetite, and investment horizon. A young professional looking to build passive income might focus on equities, while a soon-to-retire investor may shift towards fixed-income and safer investment options.

Why Asset Allocation is Smart Investing

Markets rise and fall. One year, stocks soar. Another year, bonds might outperform. With proper asset allocation, you don’t rely on luck — you rely on strategy.

Here’s why it’s one of the top smart investing moves:

- Minimizes risk by spreading investments

- Offers consistent returns over time

- Shields you from the full impact of market volatility

- Keeps your portfolio aligned with your predetermined financial goals

Asset allocation doesn’t eliminate risk — but it makes your investment strategy more resilient.

3 Steps to Smarter Asset Allocation

- Assess Your Risk Tolerance

Are you willing to ride out market dips for higher returns, or do you prefer a steady, low-risk journey? Knowing your comfort level with risk is the cornerstone of money management.

- Define Clear Financial Goals

Are you saving for a child’s education, your dream home, or a business venture? Your goals — and the timeline to reach them — determine your asset mix and help you choose the right investment options.

- Review and Rebalance Regularly

A set-it-and-forget-it approach doesn’t work in investing. Review your investment portfolio every 6–12 months and rebalance as needed. This helps you stay on track and adjust to market changes.

Investment Tips for Beginners: Start Simple

If you’re just starting your journey in smart money management, here’s a beginner-friendly allocation model:

- 60% equities for long-term growth

- 30% fixed-income instruments for safety and steady returns

- 10% liquid assets for flexibility and emergency needs

This balanced model works as a base. As your income, knowledge, and confidence grow, you can explore other investment options or consult a financial advisor to refine your strategy.

Conclusion: Invest With Intention

Smart investing is not about reacting to market noise — it’s about staying true to your vision. Asset allocation gives your investment strategy a clear direction. It empowers you to grow your financial wealth, create passive income, and reach your dreams with discipline and peace of mind.

No matter where you are on your wealth journey, the right asset allocation acts as the anchor to your success. Build it wisely, review it often, and let it guide your path to financial independence.